This article is an extension to the first article shared last week, if you haven’t read would recommend you to read it by clicking here. The aim of this article is understanding why money laundering is done and the first example of smurfing/structuring is understood along with what measures the banks take in order to identify such activities. The other examples as discussed in the first article will be discussed in detail in the following articles.

Why is money laundering done?

The purpose of these criminal organisations is to generate profits for the group or for one of its individual members. When a criminal activity generates substantial profits, the individual or group involved in such activities route the funds to safe heavens by disguising the sources, changing the form or moving the funds to a place where they are less likely to attract attention. The logic of controlling the drug money trial is that profit motivates drug sales, and because most sales are in cash, the recipient of cash has to find some way of converting these funds into utilizable financial resources that appear to have legitimate origins

What impact does money laundering have ?

- Potential damage to reputation of financial institutions and market

- Weakens the “democratic institutions” of the society

- Destabilises economy of the country causing financial crisis

- Give impetus to criminal activities

- Policy distortion occurs because of measurement error and misallocation of resources

- Discourages foreign investors

- Encourages tax evasion culture

- Results in exchange and interest rates volatility

- Causes financial crisis

Now let’s get into the first method of how money laundering occurs under the smurfing/structuring of cash route.

How does structuring work ?

A large transaction is broken into two or more smaller transactions conducted by two or more people.

Jeniffer wants to send a $5000 money transfer, but knowing that in her country there is a threshold of $3000 for the recording of funds transfer, she sends a $2500 money transfer and asks her friend to send another $2500 money transfer.

This is similar to the fraud performed by people when they submit bills for reimbursement in their office, smaller bills are added in on periodic basis to ensure that they don’t get caught.

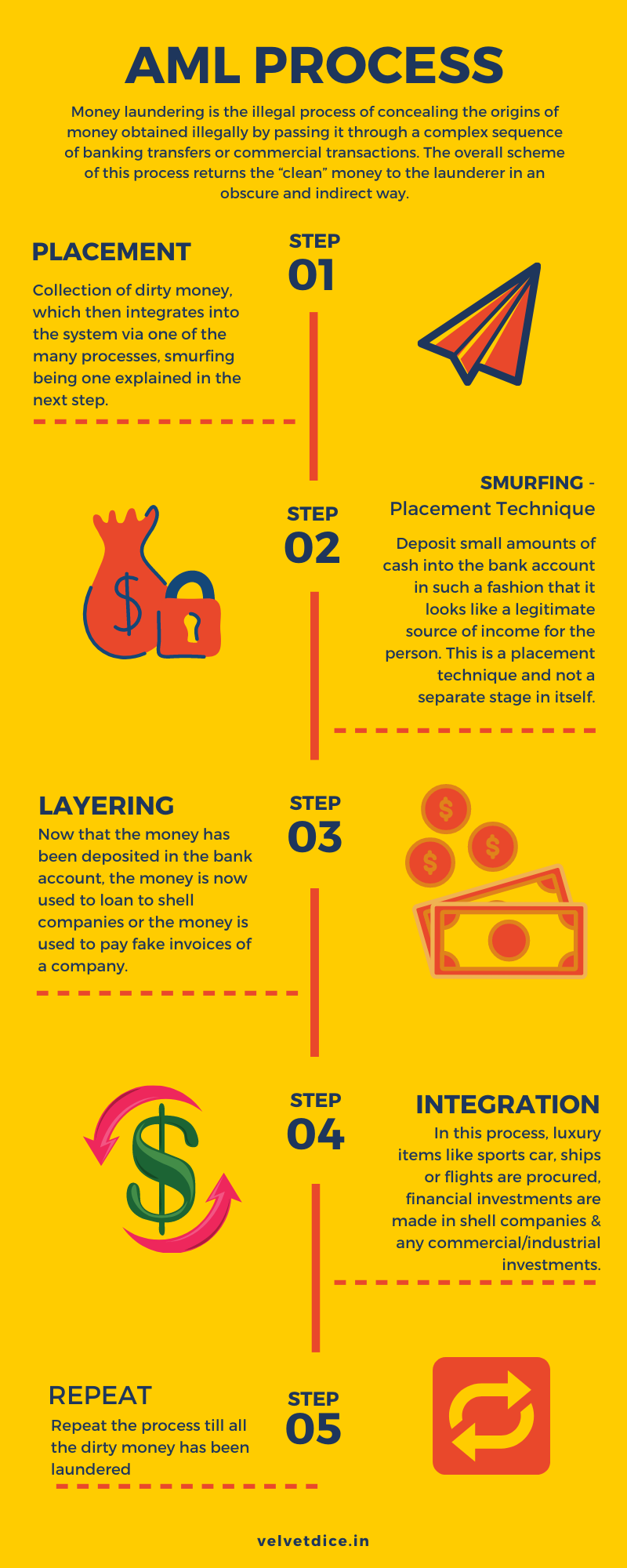

Let’s understand the AML process, the below is a representation of the stages of AML. Note that Smurfing is a placement technique and not one of the stages of the money-laundering.

Real Life Cases:

California Man Sentenced for Structuring Cash Deposits

On July 21, 2014, in Bakersfield, California, Miguel Antonio Ruiz Jaramillo was sentenced to 12 months in prison and ordered to pay $91,527 in unpaid federal taxes. According to court documents, from January 2010 through July 2012, Jaramillo cashed more than fifty checks in amounts of $10,000 or less at a bank located in Bakersfield, totaling more than $420,000. Jaramillo had the checks cashed in this manner to prevent, or attempt to prevent, the bank from filing a currency transaction report on those transactions. He did not want a report filed because for the years 2010 and 2011, he did not declare the structured cash transactions as income on his federal tax returns.

Doctor Sentenced for Tax Evasion and Currency Structuring

On April 28, 2014, in Macon Ga., Robert Sperrazza, M.D., formerly a resident of Lee County, Georgia, was sentenced to 36 months in prison and ordered to forfeit $870,238 to the United States. Sperrazza was convicted by a jury on June 7, 2013 of three counts of tax evasion and two counts of currency structuring. According to trial evidence, Sperrazza personally cashed over one million dollars in patient checks at the counter of a local bank, in Albany, Georgia. Sperrazza structured the cash transactions in amounts under $10,000 for the purpose of evading the bank reporting requirements of federal law and for the purpose of furthering his tax avoidance scheme. Sperrazza was formerly an anesthesiologist in Albany, Georgia. He later moved to Panama City Beach, Florida where he briefly operated a pain clinic. Sperrazza is not currently involved in the practice of medicine.

How do you think banks handle this?

It is possible that certain businesses have cash transactions on daily basis that may be deposited in the bank very next day. This is usually the business practice because small businesses don’t prefer carrying large amounts of cash in hand rather deposit in the bank and earn interest.

Banks use knowledge based AML systems that use machine learning to understand if the amounts deposit do not breach the threshold limit or if similar transactions are being performed over a period of time for them to be categorized under suspicious transactions. In the next article, we will speak about network modelling, clustering and time series is used to identify such anomalies or suspicious transactions in the bank account of the customers that carry out smurfing/structuring work.

In this series of articles, we will deep dive into the other ways in which money laundering is carried out, so keep following us for more. Until Next Time !

If you wish to connect with me on linkedin click here.

Leave a Reply