Order to Cash also known as O2C or OTC, refers to a set of business processes that starts from receiving order from the customer, shipping the goods or services to the customers and receiving the payment for same. These processes are the heart of the businesses and are considered critical processes to drive the top line of the company. Every department in the company is reliant or dependent directly or indirectly to this process.

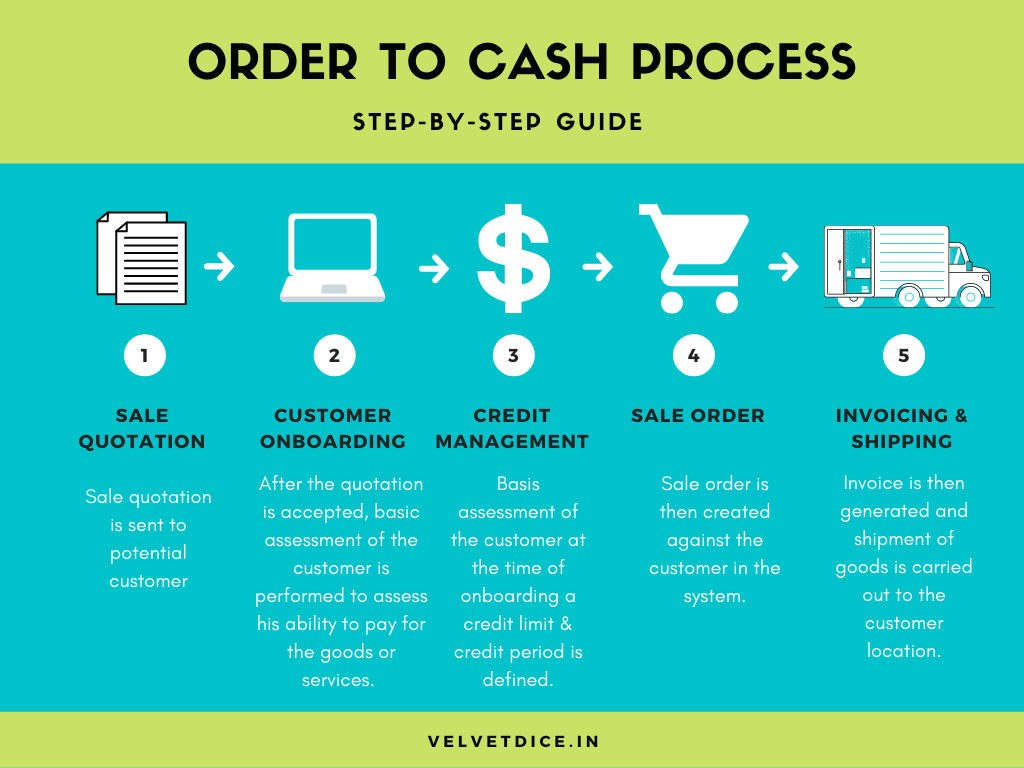

For any process to be audited it is important to understand the organisation policies & procedures, the organisation structure and during the walkthrough understand the design of the processes. Here’s a simple look at the process involved in O2C:

In an ideal world, this would be the simple chain that ensures that the customer gets his product and the company gets their payment. However, there are always glitches in every system, and unless companies deal with them quickly, they could hamper the smooth flow of business and profitability.

While auditing this process, it is important to keep one crucial point that is the sales are driven directly by the CEO/MD of the company and while noting observations it is important to be doubly sure of the observations that are put forward to the management. It is also important to note that most of the data that is used while analysing is considered sensitive in nature, so be mindful of not losing the data.

It is better to pick an approach that is not routine or that comes straight from the checklist that you received before the start of audit. Understand the processes & procedures followed by the sales personnel and try to improvise on that. Sales people are quite finicky and to identify process improvements and then to get them on board could sometime prove difficult.

Here are some of the key analytics indicators:

This internal audit guide has been divided into the following key sub-processes within the Order to Cash business cycle:

- Sales Forecasting

- Customer Identification

- Customer Credit Evaluation

- Price Master Maintenance

- Sales Order Processing

- Product Dispatch

- Invoicing

- Collections and Accounts Receivables

- Sales Returns

What should Organisations do?

Organisations should ensure that the customer onboarded is indeed capable of making the payment to the company and take a holistic approach in ensuring that all the connecting processes to the sale are carried out in an accurate manner. Organisations should ensure that the person handling the sale doesn’t just bring any other customer but a credit-worthy customer. They should make use of the ERP to the fullest extent and data analytics to spread their reach and approach to obtaining new customers. They should also leverage on the advantage of automation in ERP where the sale order/invoice is automatically generated at certain periodic intervals depending upon the type of business.

Thanks for reading. Until next time!

Thank you for this crisp article 🙂

Good article.

Thank you 🙂

Thank you 🙂

Thanks for the insight into overall process of O2C audit